Film Tax Credit up for renewal in state budget

Queens resident Julian Montoya knew he wanted to be involved in the film industry after witnessing the backdrop and scenery of New York City in the original 1990 movie “Teenage Mutant Ninja Turtles” as a kid.

It wasn’t until after studying at Queensborough Community College when Montoya found out about the “Made in NY” Production Assistant training program, developed in partnership with the Mayor’s Office of Media and Entertainment and Brooklyn Workforce Innovations.

Montoya’s youthful aspirations were able to become a reality with the help of the training program and the New York State Film Tax Credit, which incentivizes filming in-state.

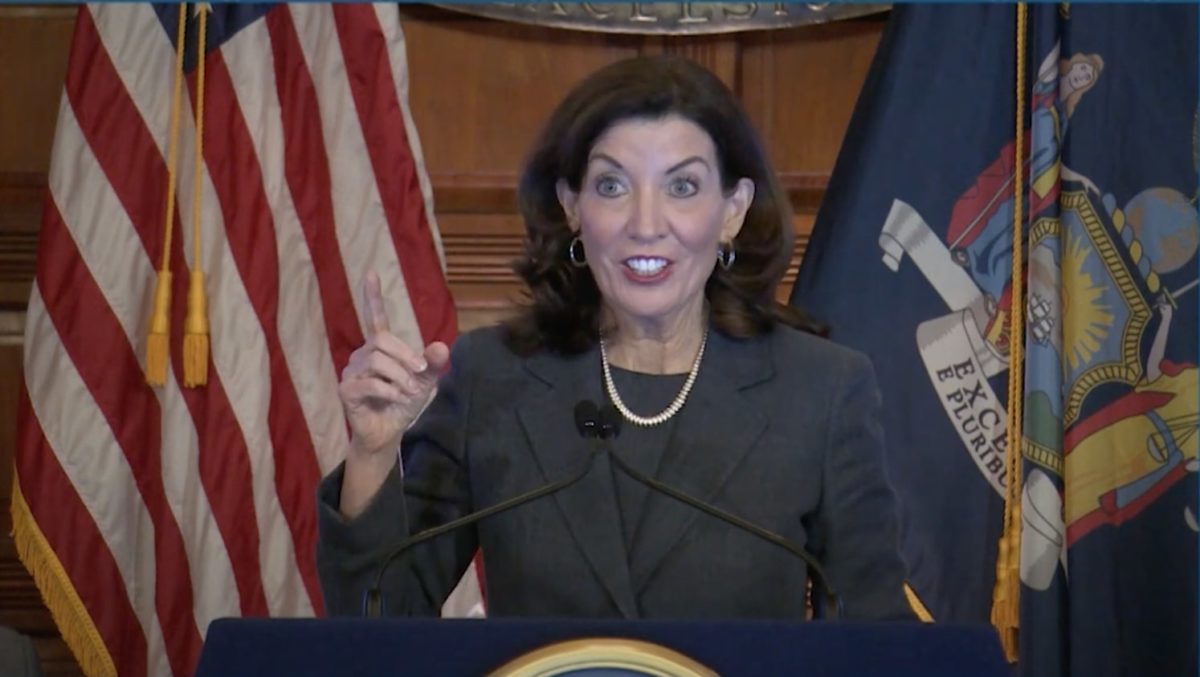

This year, the film tax credit program is up for renewal, as Governor Kathy Hochul has proposed to extend the program by three years, according to her office’s 2023 fiscal year executive budget. If approved, the program would expire in 2029 rather than 2026.

In 2009, a total of 44 states had offered some sort of film incentive programs. That number has dwindled to 31 states some nine years later.

Established in 2004 with an initial annual budget of $25 million, the film tax credit now has an annual budget of $420 million. The program offers a 25 percent fully refundable tax credit on production and post-production expenses incurred in the state. The program also offers additional credits for labor costs in counties outside of New York City.

For workers on production sets like Montoya, that means a steady flow of television and film jobs that are retained in New York.

“I always like to say who you know gets you the job, but what you know keeps you the job,” Montoya, a Teamsters Union member, said. “The information I was learning allowed me to keep my job. They gave me the tools to become successful in the business.”

In 2014, Montoya had the opportunity to work behind the scenes on the political drama series, “Madam Secretary” when it was filming in Queens.

An eight-month battle with cancer didn’t slow Montoya down either, as he was back working in the industry for location jobs and later earned his Commercial Driver’s License to take advantage of more opportunities available to him.

“The opportunities have kept coming and coming and coming,” he said. “Now, I’m in a great financial situation.”

For lifelong Queens resident and location scout Malaika Johnson, the film and television industry has directly impacted the neighborhoods in Queens where production sets come to shoot, she says.

Her role falls into the category of community relations, with checks being cut to local businesses to store equipment if necessary, and to the local bodega that takes their lunch orders.

“We might have filmed in one location, but everyone around it is affected,” Johnson said.

She says many local establishments enjoy getting the call for bulk breakfast sandwich orders and lunch orders, nearly emptying their inventory.

On a site location in Cambria Heights, Johnson recalled having to cut checks to four nearby houses on a block for aesthetic changes that the film called for.

“We’re the ones literally putting the money into the community,” she said.

Johnson added that without a state-wide film tax credit, industry jobs like hers would be lost.

“If we didn’t have the tax incentive, it’s not just we’d be out of a job. There would be a lot less money flowing into these neighborhoods,” Johnson said.